e.bike.free.fr

Le site communautaire où l'on discute des vélos à assistance électrique en copyleft, libre de tout bandeau publicitaire

Vous n'êtes pas identifié.

Annonce

#1 12-02-2025 05:49:40

- BrandiEcg5

- Membre

- Date d'inscription: 02-02-2025

- Messages: 20

- Site web

*

DeepSeek's low-cost design improves hope for China AI transformation

DeepSeek stirs nationalistic fever amid Sino-U.S. rivalry

AI-related stocks in China and Hong Kong rise

By Samuel Shen and Jiaxing Li

SHANGHAI/HONGKONG, Feb 6 (Reuters) - Chinese investors are hurrying into AI-related stocks, betting the expert system advance of home-grown start-up DeepSeek will cause a boom in the sector wiki.eqoarevival.com and offer the effort to China in a magnifying Sino-U.S. innovation war.

Feverish purchasing has pumped up shares of Chinese chipmakers, software application designers and information centre operators amid patriotic calls for an upward repricing of Chinese properties as U.S. President Donald Trump recharges a trade war with fresh tariffs.

"DeepSeek's development reveals Chinese engineers are creative and capable of inventions that can complete with Silicon Valley," said China Europe Capital Chairman Abraham Zhang. "It has actually also stirred nationalistic fever in capital markets."

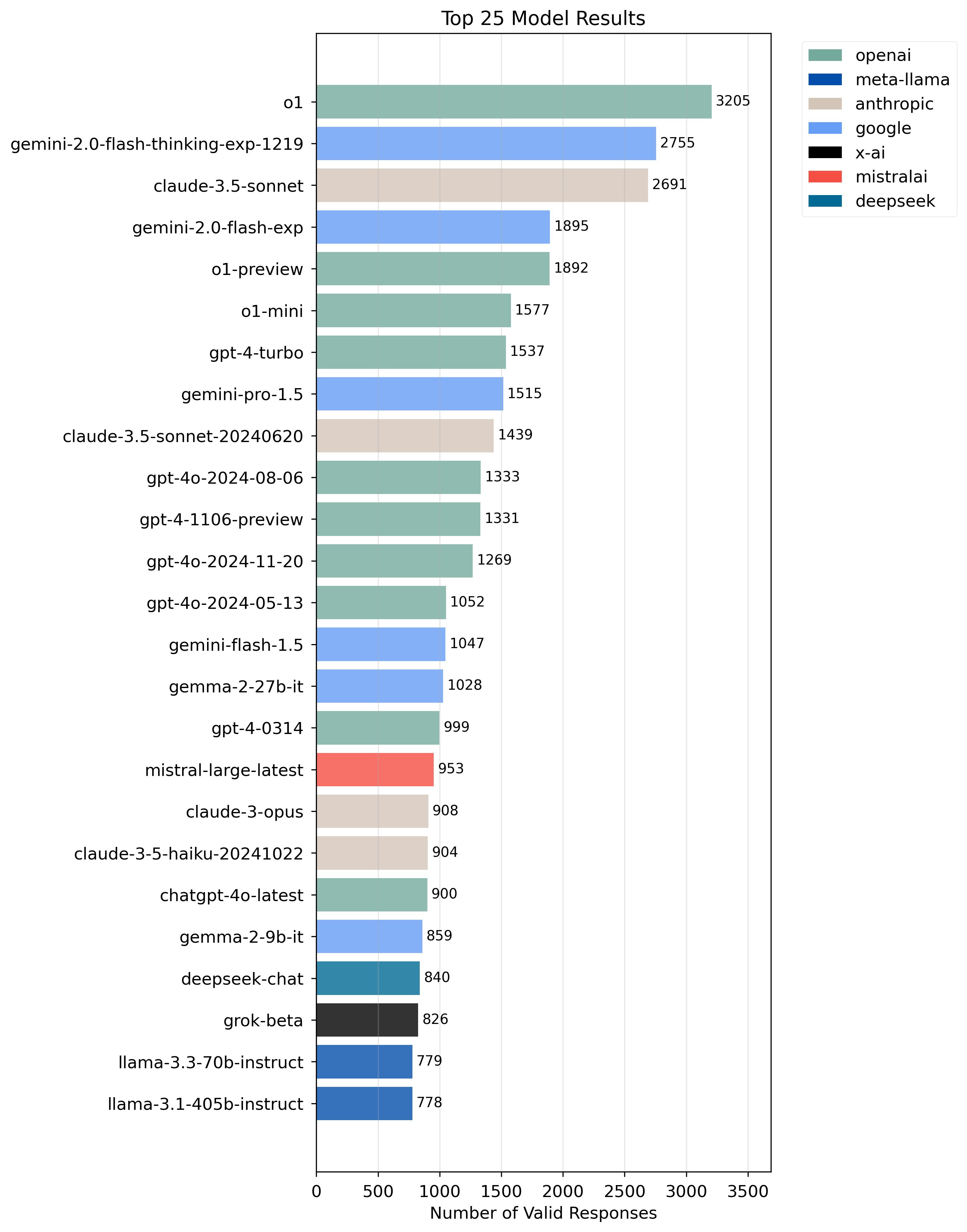

DeepSeek surprised Silicon Valley and rocked Wall Street late last month with the announcement of a competitive large language model that was ostensibly less expensive to establish than those of big-spending U.S. leaders such as OpenAI and Meta.

The occasion was explained as a watershed moment by Huaxi Securities experts and has actually given that seen money gushing into AI-related stocks in mainland China and Hong Kong.

The Hang Seng AI Index has jumped more than 5% today while indices tracking chipmakers and IT firms surged more than 11%, assisting stable the Hong Kong market as the U.S. included a 10% tariff to Chinese imports.

On the mainland, financiers returning from a week-long Lunar New Year holiday on Wednesday also piled into the tech sector, improving shares of companies in AI, semiconductors, big information and robotics.

"2025 will witness an explosion of AI applications," said Zhou Yingbo, head of investment at Futures Vessel Capital.

"We're extremely positive about chances created by this transformation," Zhou said, anticipating extensive adoption of both AI hardware and software application by customers and businesses alike.

Likely recipients consist of Nancal Technology, Suzhou MedicalSystem Technology, Doctorglasses Chain, Bestechnic Shanghai and Ucap Cloud Details Technology, Huaxi Securities said.

The DeepSeek advancement shows how the U.S. attempt to slow China's technological development "has actually backfired, instead speeding up Chinese AI innovation," TF Securities said in a client note. It called for a repricing of Chinese innovation stocks which have underperformed U.S. peers in the last few years amidst increased regulative scrutiny and geopolitical stress.

The introduction of DeepSeek might prompt even tighter U.S. innovation export constraints however that will only invite more federal government support and turbo-charge development, the brokerage said.

Goldman Sachs expects Chinese breakthroughs in AI advancement and application "could materially change" the stock exchange trajectory.

The Wall Street bank estimates AI-enabled performance improvement might increase profits by 2% for Chinese equities, while brighter growth potential customers might cause a 20% appraisal uplift for Chinese firms, narrowing the space with U.S. peers.

China's "difficult tech" stocks trade at a price representing 23.6 times earnings, while "soft tech" shares trade at 13.9. The price-to-earnings ratio of the biggest U.S. tech stocks, the so-called "Mag 7", is 31, showed the Goldman report dated Feb 4.

DeepSeek has produced such a buzz that Chinese companies up and down the AI value chain, from chipmakers to cloud provider are checking out possibilities with the startup's inexpensive services, including heavyweights such as Huawei Technologies, Alibaba and Baidu.

Yi Xiangjun, partner of Shenzhen Black Stone Asset Management, said he is "all in" China's AI and tech stocks, betting big, successful business will emerge in what he called an epoch-making transformation.

However, Wang Zhuo, partner of Shanghai Zhuozhu Investment Management, was more careful.

"Many business are still far method from creating earnings from AI ... As a worth financier, I don't feel great putting money into these stocks." (Reporting by Samuel Shen and Jiaxing Li; Editing by Vidya Ranganathan and Christopher Cushing)

my homepage - ai

Hors ligne